A Guide to Your Statement | Frequently Asked Questions

Steps to Make Your Payment

Paying your maintenance fees and taxes is easy. On the Ownership page, you can select a property to view and manage your maintenance fees.

- Select View Maintenance Fees.

- If you have maintenance fees due you will see the Make a Payment button located in the Account Summary section.

- You will be directed to the Make a Maintenance Fee Payment page with a breakdown of the fees due.

- Enter your credit card information in the Select Payment Method section.

- Select Continue to complete your transaction.

Ready to make a payment? Get started below.

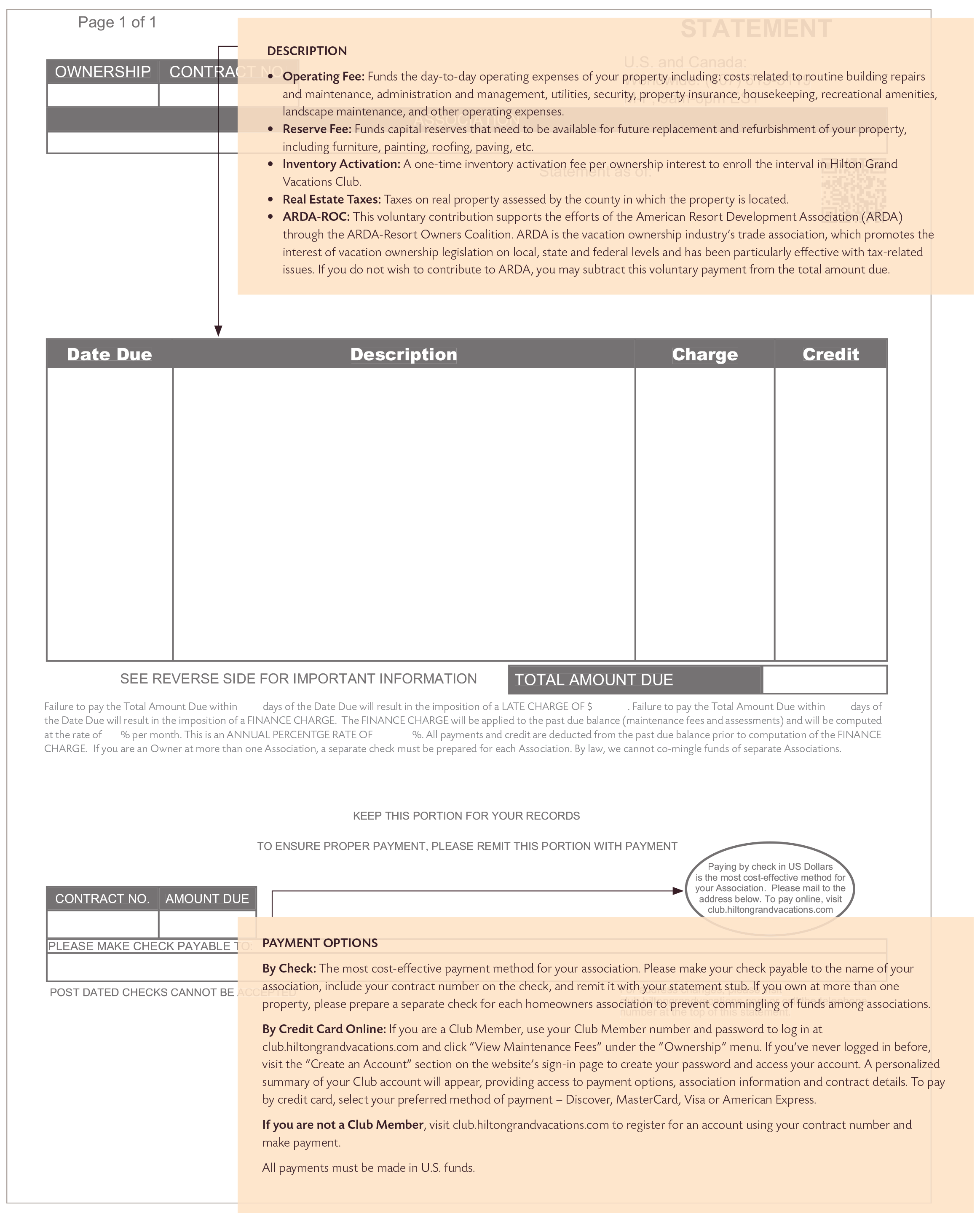

Understanding Your Statement

This guide is intended to help you familiarize yourself with the format of your statement as well as the fees and taxes that make up your annual maintenance assessment. The Board of Directors of your homeowners association is responsible for establishing the annual budget and maintenance fees for your Home Resort.

The budget covers the cost of operating, maintaining and, when necessary, refurbishing your property. Your Board of Directors and Hilton Grand Vacations work carefully to establish the annual budgets, addressing the need to maintain your property while managing increases to your annual maintenance fees.

A Guide to Understanding Your Statement is available as a PDF download.

Frequently Asked Questions

Maintenance Fees

Budget

Reserve Funding

Real Estate Taxes

Third-Party Exit Company Fraud

ARDA

Ready to Make Your Payment?

Paying your maintenance fees and taxes is easy. On the Ownership page, you can select a property to view and manage your maintenance fees.

Ready to make a payment? Get started below.

PAY MAINTENANCE FEEUnderstanding Your Hilton Grand Vacations Maintenance Fees

How are my maintenance fees spent and why do I pay them?

Ever wonder why you pay maintenance fees and how they are spent? Your annual Hilton Grand Vacations maintenance fee ensures that all aspects of your Home Resort meet the high standards you expect from the Hilton Grand Vacations brand. These fees cover three major expense categories, ensuring your resort remains in top condition.

How is my reserve budget calculated?

Want to dig deeper to understand the capital reserve portion of your Hilton Grand Vacations maintenance fee? Check out how we calculate and spend the reserve portion of your maintenance fee.